The recent rise in the DXY, increasing fear in the market, and falling asset prices have emphasised the importance of holding cash. It is likely that a significant portion of portfolios will continue to be held in cash. With this in mind, let’s examine the stablecoin market and determine which stablecoin is the safest option to hold.

There are several different types of stablecoins, including:

- Fiat-collateralized stablecoins: These stablecoins are backed by a reserve of fiat currency, such as the US dollar or euro. The value of the stablecoin is then pegged to the value of the underlying fiat currency.

- Algorithmic stablecoins: These stablecoins are not backed by any specific asset but are instead maintained through the use of algorithms that automatically adjust the supply of the stablecoin to maintain its value.

- Gold-backed stablecoins: The idea behind a gold-backed stablecoin is to provide a stable store of value and a hedge against inflation, similar to the traditional role that gold has played in finance and investment. Gold-backed stablecoins are typically issued and backed by physical gold held in a secure vault, and the issuer may provide regular audits and other forms of transparency to demonstrate the backing of the stablecoin with physical gold.

Twitter Users Cast Their Votes

We have included 3 polls with over 2,000 votes each on which stablecoin Twitter voters believe is safest

So, Which Stablecoin is the Safest?

When it comes to determining the safest stablecoin, there are several factors to consider. These include:

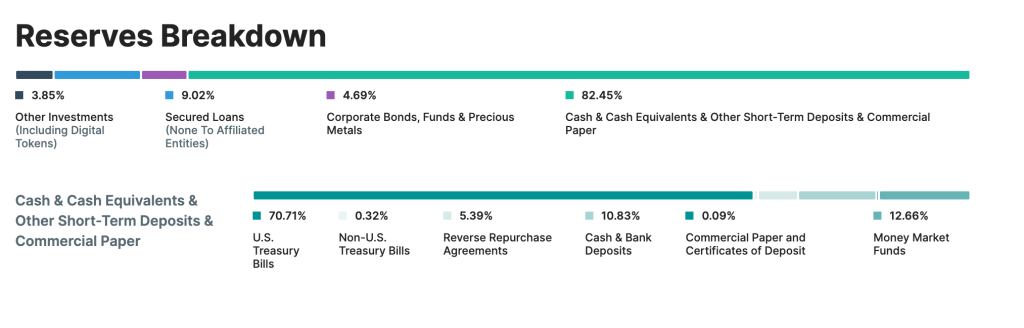

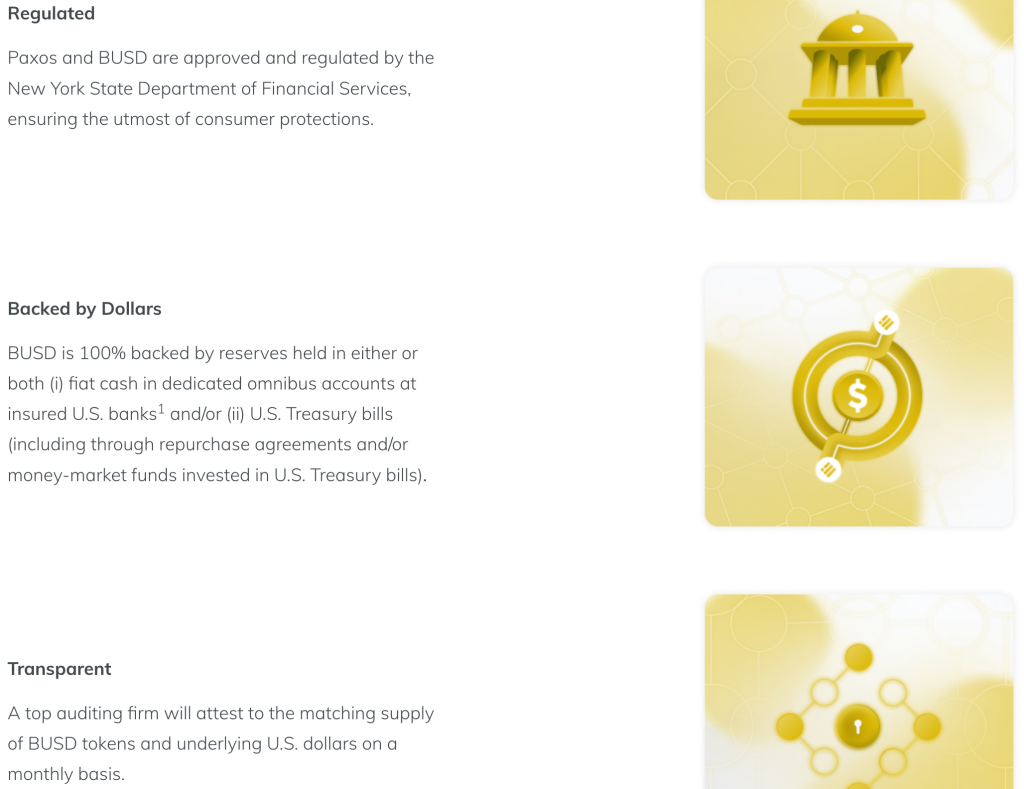

- Collateralization: One of the most important factors to consider when evaluating the safety of a stablecoin is the level of collateralization. This refers to the amount of assets that are backing the stablecoin.

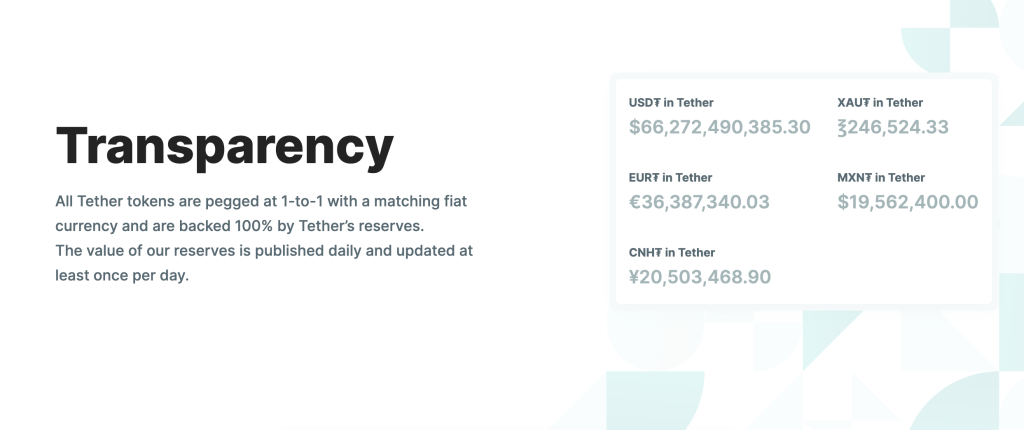

- Transparency: Another important factor to consider is the level of transparency of the stablecoin. A transparent stablecoin is one that provides clear information about its operations and holdings, including the amount of assets that are backing the stablecoin.

- Decentralization: Decentralization is another important factor to consider when evaluating the safety of a stablecoin. A decentralized stablecoin is one that is not controlled by a single entity, such as a central bank or government.

Transparency

We’ve gone through the transparency sections of each coin to highlight the most important information for you to make your own decision on which stablecoin is safest.

USDC

USDT

BUSD

PAXOS (USDP)

PAXG

Conclusion

In conclusion, there are several factors to consider when evaluating the safety of a stablecoin. These include collateralization, transparency, and decentralization. While no stablecoin is completely risk-free, fiat-collateralized stablecoins and transparent, decentralized stablecoins tend to be the safest options. It is important to do thorough research and due diligence before investing in any stablecoin, as the level of risk may vary depending on the specific characteristics of the stablecoin.

Which stablecoin do you trust most? Leave your thoughts below.

Article written by JayXBT