Genesis Global Trading, a New York-based digital currency firm, is claimed by Cameron Winklevoss to be in debt to Gemini Trust Company, to the tune of $1.675 billion. The debt is said to be in the form of unpaid loans that were extended to Genesis by Gemini.

Barry Silbert vehemently disagreed and he replied with his version of events

Concerns Raised

The news of the alleged debt between Genesis and Gemini has caused concern within the cryptocurrency community. Some are speculating that the large debt could be seen as a sign of financial instability within the industry, and may lead regulatory bodies to scrutinise cryptocurrency more closely. It is still unclear how the situation between Genesis and Gemini will be resolved.

Grayscale Trust

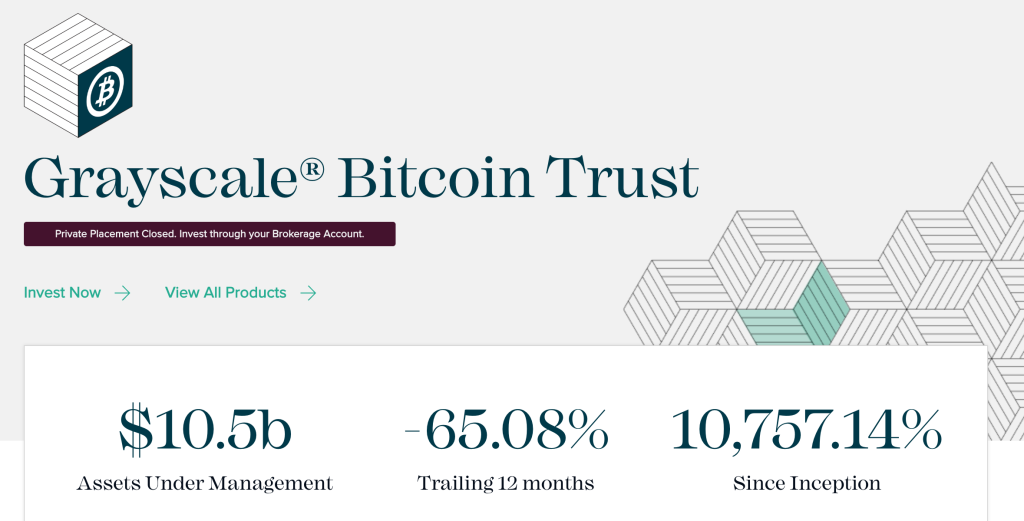

Grayscale is a digital currency investment firm that offers a range of investment products, including trusts and funds, that allow investors to gain exposure to various digital currencies such as Bitcoin and Ethereum. If Grayscale were ever unable to fulfil its financial obligations, it would have very negative consequences for the broader market, depending on the extent of its financial distress and the number of people affected. It’s important to note that Grayscale is a well-established company that has been in operation since 2013.

Grayscale manage a monumental amount of crypto assets with total assets under management currently valued at a whopping $10.5 billion [1]

Grayscale assets include Bitcoin, Ethereum, Filecoin, Solana, Stellar, Zcash, and more.

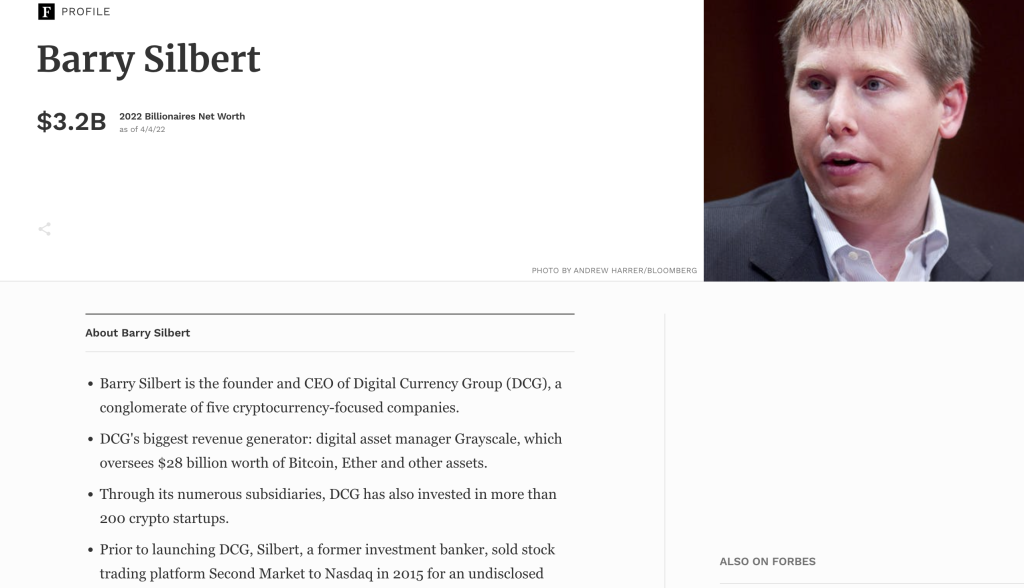

Who are Barry Silbert and Digital Currency Group (DGC)

Let’s take a look at the Forbes profile of Barry Silbert [2]

Regulations and CBDCs

Events such as these unsettle investors and regulators will surely have more evidence to pounce on if any further bankruptcies occur amongst the top companies in the industry. CBDCs are something that regulators are currently working on. For more on CBDCs, check our article below

The public spat between Cameron Winklevoss and Barry Silbert hasn’t caused any large sell-off in the market yet, in fact, the opposite is true, the market has been experiencing a slight pump since the story broke a couple of days ago.

Some would state that airing dirty laundry in public never ends well, what do you think will happen between Gemini and Genesis?

Article written by JayXBT, tweets below